Walmart Exports: When Platforms Take Over Global Trade

Walmart’s launch of Walmart Exports is not about helping sellers reach Canada and Mexico. It’s about reducing friction in cross-border commerce by absorbing it entirely into the platform. By automatically enrolling Walmart Fulfillment Services inventory into international markets, Walmart is signaling a broader transition: global trade is no longer a merchant capability — it is becoming a platform primitive. The critical detail is automation without opt-in. Sellers are not building export systems, managing customs, or controlling cross-border logistics. Walmart is doing that on their behalf. This mirrors a broader trend across digital platforms where complexity is centralized and sellers are repositioned as inventory suppliers rather than operators. Reach increases, but control quietly diminishes. Canada and Mexico are not the story. They are rehearsal markets. The signal is the infrastructure being built behind the scenes — one that allows Walmart to scale cross-border commerce into additional countries without sellers ever touching export mechanics. In this model, platforms don’t enable trade. They become the trade layer.

Electricity Disruptions Across Nigeria and Africa — Operating Under Constraints

Today — Jan 15 | Mbariket Live Briefing on YouTube Electricity Disruptions Across Nigeria and Africa — Operating Under Constraints 🕑 2:00 PM PT (USA)🕚 11:00 PM WAT (Nigeria)🕙 10:00 PM GMT (UK)🕔 5:00 PM ET (Canada) Contributors share field reality—downtime, costs, and constraints shaping daily output. Watch Live on YouTube:https://www.youtube.com/live/8863OomULWU?si=YO8NnPxEy0BPJPAM Zoom (Live Contribution Only):https://us06web.zoom.us/j/82433466749?pwd=z9GdKFaVkXshIXmflPdN4ld4WOeR8P.1 Electricity Disruptions Across Nigeria and Africa — Operating Under Constraints is a live diagnostic focused on output. This is not a Q&A and not a product discussion. Callers contribute field reality—downtime, fuel exposure, maintenance friction, and lost hours. The session opens with three diagnostics that surface how electricity disruption is already shaping daily productivity across Nigeria and Africa. The baseline is direct: intermittent power is normal, diesel is expensive and fragile, and most businesses already self-provision. The issue is not access to electricity—it is continuity of output. A short interaction window confirms this reality from operators on the ground, followed by a systems shift outlining the move from fuel dependence toward controllable uptime through layered power systems. Global providers in the portable energy space are referenced only as signals, not solutions, to contrast assumptions. In most markets, disruption is treated as an exception. In Africa, it is the operating environment. The close identifies the real gap—not technology, but localization across financing, service, training, and durability—and ends with a clear implication: Africa will not wait for infrastructure to improve before it operates.

New U.S. Visa Suspensions — What It Means for Nigeria

The United States has temporarily suspended immigrant visa processing for Nigeria and several other countries. This development should not be read as an isolated action or a Nigeria-specific signal. It reflects a broader recalibration underway across major destination countries as migration systems face capacity, verification, and integrity pressures. Canada has tightened pathways and raised scrutiny across student and work programs. The United Kingdom has narrowed eligibility, adjusted dependent rules, and elevated enforcement standards. Across Europe, asylum thresholds are being raised, processing timelines extended, and admission criteria refined. Nigeria is not being singled out. Nigeria is being evaluated within a wider global filter that now emphasizes clarity, qualification, and risk management. The door has not closed—but it no longer swings freely. Access remains available to those who meet requirements cleanly, document their intent clearly, and fit within the tightening definitions of admissible global mobility. Watch the Mbariket Podcast livestream.

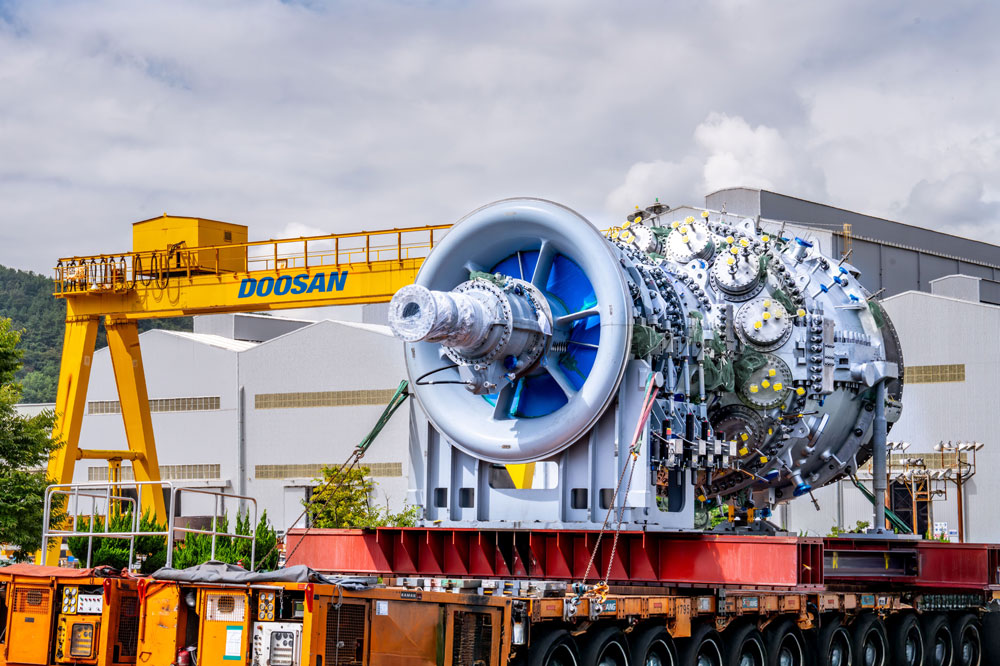

Doosan Group Press Release (Energy Solutions for AI Infrastructure)

Doosan Group has shared the following press release outlining its energy solutions supporting AI infrastructure through Doosan Enerbility and HyAxiom. The full release is provided below for audience reference. CES 2026 – Doosan Presents Comprehensive Energy Solutions for the AI Era Doosan Enerbility and HyAxiom showcase energy portfolio powering AI infrastructure, spanning large-scale gas turbines, small modular reactors (SMRs), and fuel cell technologies. Las Vegas, NV (January 06, 2026) – At CES® 2026, Doosan Group, through its industry-leading energy subsidiaries Doosan Enerbility and HyAxiom, will unveil a portfolio of next-generation solutions designed to meet the massive energy demands of the AI era. The companies will showcase their technologies January 6–9 in West Hall, Booth 5840 at the Las Vegas Convention Center. As AI adoption accelerates, some estimates suggest data centers could account for up to 12% of all U.S. electricity consumption by 2030. Doosan is tackling this challenge with cleaner, more scalable, and more efficient energy systems spanning gas turbines, SMRs, and fuel cells. At the Doosan booth, visitors will have the opportunity to explore these technologies in greater detail and gain a clearer understanding of how Doosan is powering the AI era. Gas Turbines: Proven, Large-Scale Power for AI Infrastructure Doosan Group’s energy portfolio begins with large-scale gas turbine technology designed to deliver dependable, scalable power for AI data centers. Doosan is the first in Korea and fifth worldwide to independently develop and commercialize a large-scale gas turbine. Doosan’s gas turbine technology is validated through deployments and long-term operations across multiple facilities. Today, Doosan’s gas turbines continue to serve as reliable power sources for energy-intensive AI infrastructure, and the group is expanding its leadership in scalable energy solutions by recently securing supplier contracts with a prominent U.S. tech company. Looking ahead to 2028, Doosan is developing the 100% hydrogen-fueled large gas turbine, a milestone poised to accelerate the transition to a low-carbon energy future. SMRs: Flexible, Zero-Carbon Baseload Energy Building on decades of leadership in nuclear energy, Doosan delivers next-generation power solutions through its Small Modular Reactor (SMR) technologies. As an SMR foundry, Doosan partners with leading SMR developers to manufacture core reactor components for advanced nuclear power plants worldwide. Doosan’s SMR solutions provide stable, zero-carbon baseload energy that can be precisely scaled to match the size, output, and operational requirements of any AI infrastructure, offering flexibility unmatched by conventional power facilities. This capability is grounded in Doosan’s unique end-to-end nuclear manufacturing expertise. Doosan is the only company in the world capable of producing nuclear reactor equipment across the full value chain—from individual components to finished products. Since the 1980s, the Group has manufactured key nuclear power plant facilities and has supplied 34 main reactor units and 124 steam generators worldwide. Fuel Cells: Rapid-Deployment Clean Power Complementing large-scale and baseload generation, HyAxiom’s fuel cell technologies address the need for rapid deployment and localized power generation. A pioneer in fuel cell innovation, HyAxiom supplied hydrogen fuel cells for the Apollo space program and has since delivered both the world’s largest LNG fuel cell power plant and the world’s first 100% hydrogen fuel cell power plant. Fuel cells offer a key advantage for AI infrastructure: fast deployment timelines that enable data centers to come online quickly while delivering efficient, low-emission power close to the point of use. At the booth, HyAxiom will highlight its PureCell® Model 400 (PAFC) fuel cell system, a compact power plant capable of delivering up to 460 kW of on-demand electricity. Operating on hydrogen, natural gas, LPG, or blended fuels, the system emits little to no emissions and provides enough electricity to power approximately 340 U.S. homes. HyAxiom will also feature: “The AI revolution is global and accelerating. As energy demand surges, our mission is to lead with cleaner, scalable fuel-cell solutions that support both businesses and communities,” said Doo Soon Lee, CEO of HyAxiom. Added Yeonin Jung, COO of Doosan Enerbility: “With our eco-focused vision, global partnerships, and broad portfolio—from SMRs and gas turbines to hydrogen and wind technologies—we are exceptionally well-positioned to power the next era of AI and advanced energy needs worldwide.” ABOUT DOOSAN GROUPDoosan Group, founded in 1896, is one of South Korea’s oldest and most established corporations. Today, it is a global leader driving innovation across three core business pillars: Clean Energy, Smart Machines, and Advanced Materials. Leveraging its technological strengths in next-generation energy solutions—including SMRs and gas turbines—as well as global industrial technologies such as Bobcat compact equipment and AI-powered robotic solutions, Doosan continues to expand its impact worldwide. Throughout its long history, the company has continuously transformed and advanced its business portfolio to focus on industrial technology and sustainable solutions for the future. CES 2026 — Doosan Product Teams Describe Bobcat, Hydrogen Fuel Cells, and AI Solutions

Mbariket Podcast: Walmart, Google, and OpenAI Reshape E-Commerce Around Frictionless Shopping

Friendly disclaimer: I own shares in Walmart. Walmart’s long-term performance directly impacts my portfolio, so I pay close attention to structural shifts that strengthen its position. Recent integrations with Google’s Gemini and OpenAI’s ChatGPT are not incremental features; they confirm a broader realignment already underway in commerce. This shift is about outcomes. Consumers are no longer comparison engines. They are outcome-driven. Abundance now introduces friction, hesitation, and delay. Fewer, better choices enable action. As intent becomes legible to systems, the burden of navigation disappears. Gemini interprets intent; Walmart executes through inventory, fulfillment, and timing. When interpretation and execution merge, shopping stops being a process and becomes a resolved action. This is personalization as infrastructure, not marketing. Power migrates from ads and pages to identity, data depth, and system integration. Platforms that optimize for resolution align with behavior; those that optimize for abundance work against it. The future of commerce is delegation. Choice does not vanish—it recedes behind systems that decide. Walmart, Google, and ChatGPT are not chasing convenience. They are removing friction entirely.

Portable Energy as Infrastructure

Portable power is moving from convenience into infrastructure. What was once framed as backup is increasingly part of how people, small businesses, and field operations manage energy uncertainty. The presence of companies like EcoFlow reflects a broader shift in expectations. Power is now assumed to be mobile, modular, and available on demand. Users are no longer waiting on centralized systems to respond before they can operate. This is how decentralization appears in practice. Systems that sit alongside existing infrastructure and quietly reduce dependency.

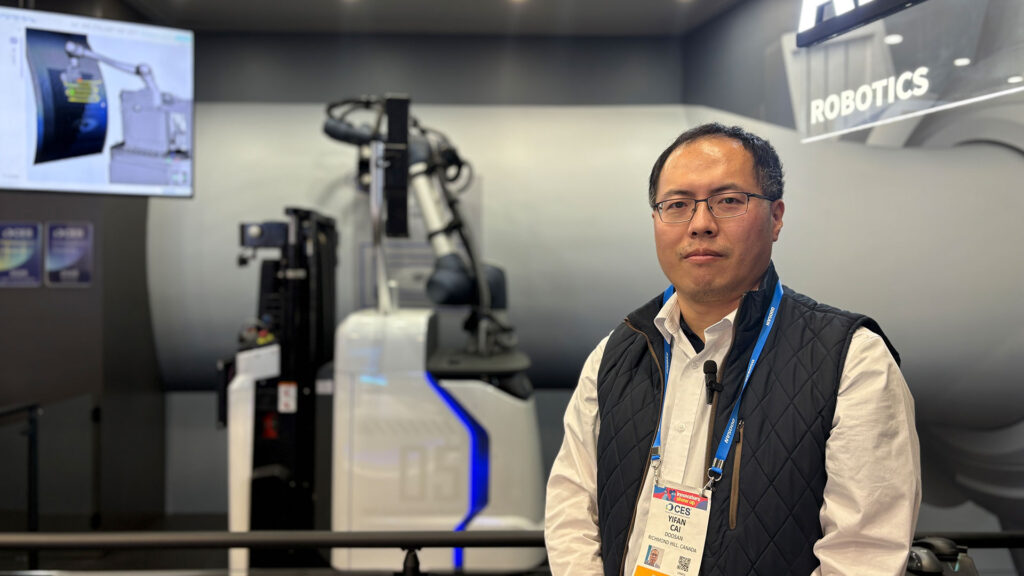

CES 2026 — Doosan Product Teams Describe Bobcat, Hydrogen Fuel Cells, and AI Solutions

At CES 2026, product teams from Doosan described their equipment, energy, and AI solutions. Bobcat machinery, hydrogen fuel cells, and AI were discussed in terms of how they interact on job sites and across industrial settings. AI is positioned above the physical layer as an organizing and optimization mechanism. Hydrogen is presented as a solution for on-site and distributed energy demands, particularly in environments where centralized power is limited or constrained. The system is described in the context of operating environments where energy availability, uptime, and coordination across equipment matter. The video captures how those conditions are shaping how the products are framed to work together.

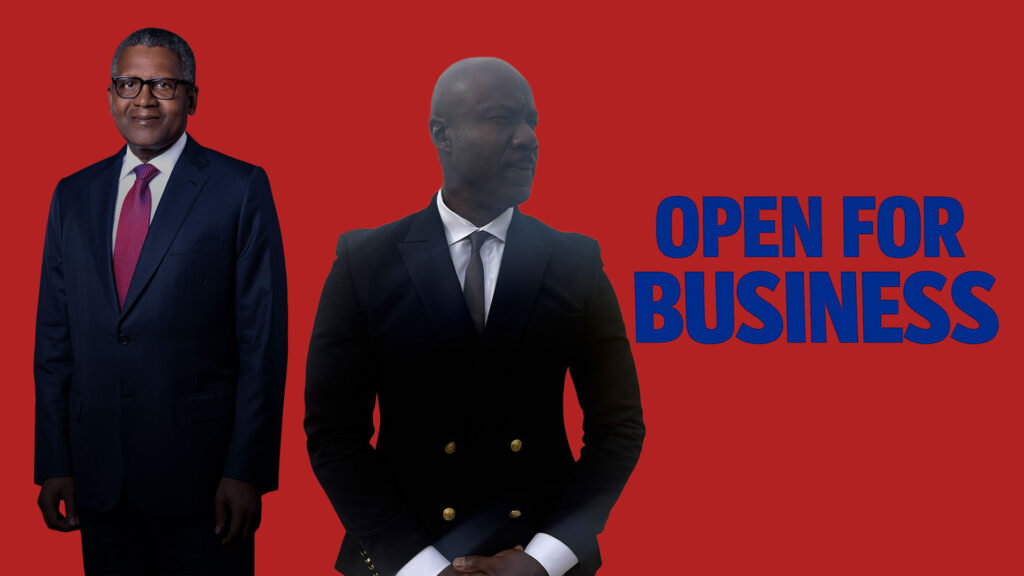

Nigeria’s Dangote Oil Refinery Is Not Shutting Down

Dangote Refinery remains operational and open for business. Recent rumors suggesting a shutdown triggered an official response from the company, published via its verified Instagram channel, making one point clear: production is stable and uninterrupted. Maintenance on individual units, a normal feature of large-scale industrial systems, has been misread as disruption. In reality, the refinery’s integrated design allows maintenance without halting output. Verified figures replace guesswork: tens of millions of litres of Premium Motor Spirit supplied daily, stock levels covering weeks of national consumption, and continuous evacuation of product. At an ex-gantry price of ₦699 per litre and daily supply volumes that materially influence market stability, the refinery is reshaping Nigeria’s energy narrative—from import dependence to domestic capacity. With plans to scale monthly supply to 1.7 billion litres from February 2026, the implication is long-term energy security, pricing confidence, and strategic leverage. Rich Mbariket Founder, Mbariket Ventures Enterprise U.S.—Nigeria Markets 🌍 https://mbariket.com

Posture in the Age of AI Agents | CES 2026 Brief

CES 2026 wasn’t about product launches or demos. It was about posture. I spent the week inside keynotes, closed demos, and enterprise floors, moving deliberately, listening more than speaking. What stood out wasn’t any single company or device. It was the collective shift from reactive AI, where humans prompt systems, to proactive AI, where systems act in alignment with intent. The signal was clear. The world is no longer experimenting around AI. It is reorganizing itself around it. Every job will change. Some roles will disappear. New ones will form. This isn’t a software cycle. It’s an industrial expansion. AI is not an app. It’s a stack. Compute. Energy. Models. Agents. Applications. Distribution. Whoever controls that stack doesn’t just ship products. They shape companies, regions, and nations. In the same way the U.S. dollar functions as global infrastructure, the American AI tech stack is positioning itself as global infrastructure. Global GDP sits around one hundred trillion dollars today. AI breaks that ceiling. Over half of the world’s AI researchers are in China. Capital, talent, energy, and compute are aligning at scale. What’s forming now will define where jobs move, where value concentrates, and which countries expand their influence over the next decade. Rich Mbariket Founder, Mbariket Ventures Enterprise U.S.—Nigeria Markets 🌍 https://mbariket.com

Sony Honda Mobility’s AFEELA and the Race to Software-Defined Vehicles

Sony Honda Mobility represents a forward-looking alignment between two strengths that increasingly define modern mobility. Sony contributes leadership in sensors, imaging, entertainment, and AI software, while Honda brings decades of manufacturing excellence, safety engineering, and global scale. The partnership reflects a shared view that the future of vehicles will be shaped as much by software and data as by hardware. AFEELA is designed around a simple idea: the car as an intelligent, evolving platform. As vehicles become more connected and autonomous, the opportunity lies in creating seamless human–machine interaction, adaptive interfaces, and digital services that improve over time. AFEELA positions mobility as an experience that grows smarter with use, rather than a static product frozen at purchase. At CES 2026, Sony Honda Mobility signals optimism about where transportation is headed. By integrating sensing, AI, and entertainment into a unified vehicle architecture, AFEELA points toward a future where cars are safer, more intuitive, and more responsive to human needs. The focus is not disruption for its own sake, but building a durable foundation for the next era of intelligent mobility.